Blogs

E Invoicing Software: Your Essential LHDN Compliance Partner in 2025

Malaysia’s mandatory e-invoicing mandate is now fully enforced. If your business hasn’t adopted LHDN-compliant solutions, you’re risking penalties of up to RM20,000 per invoice and operational disruption. SQL Accounting’s e invoicing software isn’t just a tool—it’s your safeguard against non-compliance while unlocking real efficiency gains.

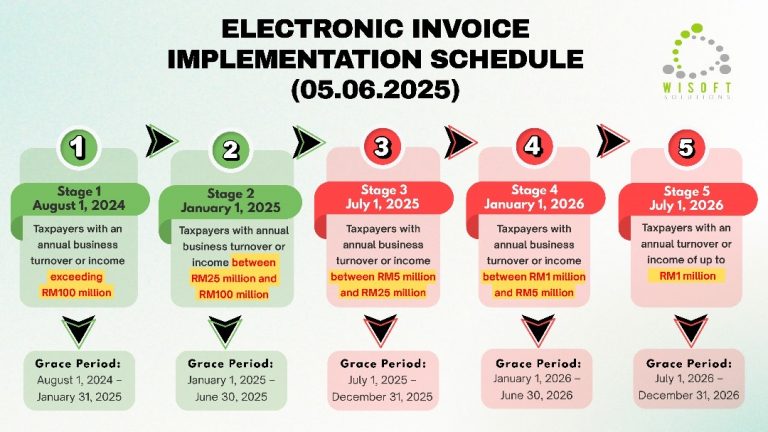

Critical Update: E-Invoice Implementation Schedule

LHDN has introduced a phased mandatory e-invoicing rollout based on annual business turnover. Each stage comes with a grace period, allowing businesses time to adapt before enforcement begins.

Stage 1 typically includes multinational corporations and large local enterprises. These businesses are expected to set the standard for early adoption and lead the industry in compliance practices.

Stage 2 targets upper mid-sized companies, many of which already operate with ERP or digital systems. These businesses are generally well-prepared to integrate e-invoicing solutions efficiently.

Stage 3 covers medium-sized businesses, many of whom still rely on manual processes or basic accounting tools. This phase marks a crucial turning point for digital transformation.

Stage 4 involves small and medium enterprises (SMEs). With limited resources, early preparation is key—SMEs should begin exploring simple, cost-effective, LHDN-compliant e-invoicing software that fits their needs.

Stage 5, the final phase, applies to micro businesses and sole proprietors—the largest group of taxpayers in Malaysia. While the shift to e-invoicing may seem overwhelming, many free or low-cost tools will be available to help ease the transition.

Don’t Delay — The Risks Are Real

Manual processes or generic tools will not meet LHDN’s strict standards. Delaying your e-invoicing adoption could expose your business to serious risks, including:

- Rejected invoices, disrupting your cash flow

- Failed MyInvois submissions, causing compliance issues

- Audit triggers, due to data mismatches or errors

How SQL’s E Invoicing Software Rescues Your Compliance

- Instant MyInvois Sync

Auto-submits invoices to LHDN’s portal, tracks validation status (Approved/Rejected), and archives compliant PDFs—bypassing manual errors. - Zero-Formatting Errors

Pre-loaded templates enforce all 53 mandatory fields, including:

- Dynamic QR codes

- Buyer/Seller TIN verification

- Correct tax treatments (SST, withholding tax)

3. Audit-Proof Digital Trail

Automatically maintains 7-year records with version history—ready for LHDN inspections.

Beyond Compliance: Tangible 2025 Benefits

- 30% Faster Payments: Validated invoices speed up client approvals

- 65% Lower Processing Costs: Eliminate printing, postage, and manual entry

- Real-Time Tax Visibility: Dashboard tracks payable/receivable SST

- Multi-Company Management: Handle branches/JVs in one platform

Why Malaysian Businesses Trust SQL

- Proven Local Expertise: More than 270,000 users

- Seamless Integration: Works with SQL’s accounting/inventory modules

- Emergency Support: On-call assistance for compliance emergencies

- LHDN-Approved Workflows: Pre-configured for manufacturing, retail, services

Act Now to Secure Compliance & Avoid Penalties

- Compliance Health Check Identify vulnerabilities in your invoicing process with SQL’s free gap analysis – uncover non-compliant transactions before they trigger audits.

- Accelerated Implementation Deploy LHDN-ready workflows in days, not months, using pre-configured industry templates that eliminate setup complexity.

- Penalty Protection Proactively correct past submissions and prevent future violations with:

- Automated LHDN annotation resubmissions

- Real-time error blocking for new invoices

- Continuous regulation monitoring

Don’t Risk Your Business’s Reputation

SQL’s e invoicing software turns compliance from a liability into efficiency. With active penalties now enforced, delay equals financial risk.